Victoria shares: how to start investing for the long term

Victoria Devine from She’s on the Money shares her top tips for long-term investing, from setting investment goals to automating your investing.

Victoria Devine is a retired financial adviser, best-selling author, and founder and host of She’s on the Money—a community of over 284,000 people, and podcast reaching 1.25 million listeners every month. Victoria is wildly passionate about transforming people’s relationships with money, and educating women about building wealth and investing for their financial future.

Investing is about making your money work for you. My biggest goal is to have financial freedom, with money coming from my investments so I don’t have to go to work every day. So many in my community want that too, so I want to share some of my investing tips to help you achieve that.

Think about why you’re investing

When you start investing, think about your goals to help you determine what investments might be suitable for you and your situation.

It’s like going to the grocery store without a list; you can make it work, but you might miss some key ingredients that you need to make dinner a little tastier than if you had planned in advance.

When thinking about your investment goals, you should consider things like your risk tolerance, what stage of life you’re in, the kind of lifestyle you currently (and in future would like to) live, how much money you’re planning to invest, and what the current market situations are.

Start with an affordable amount

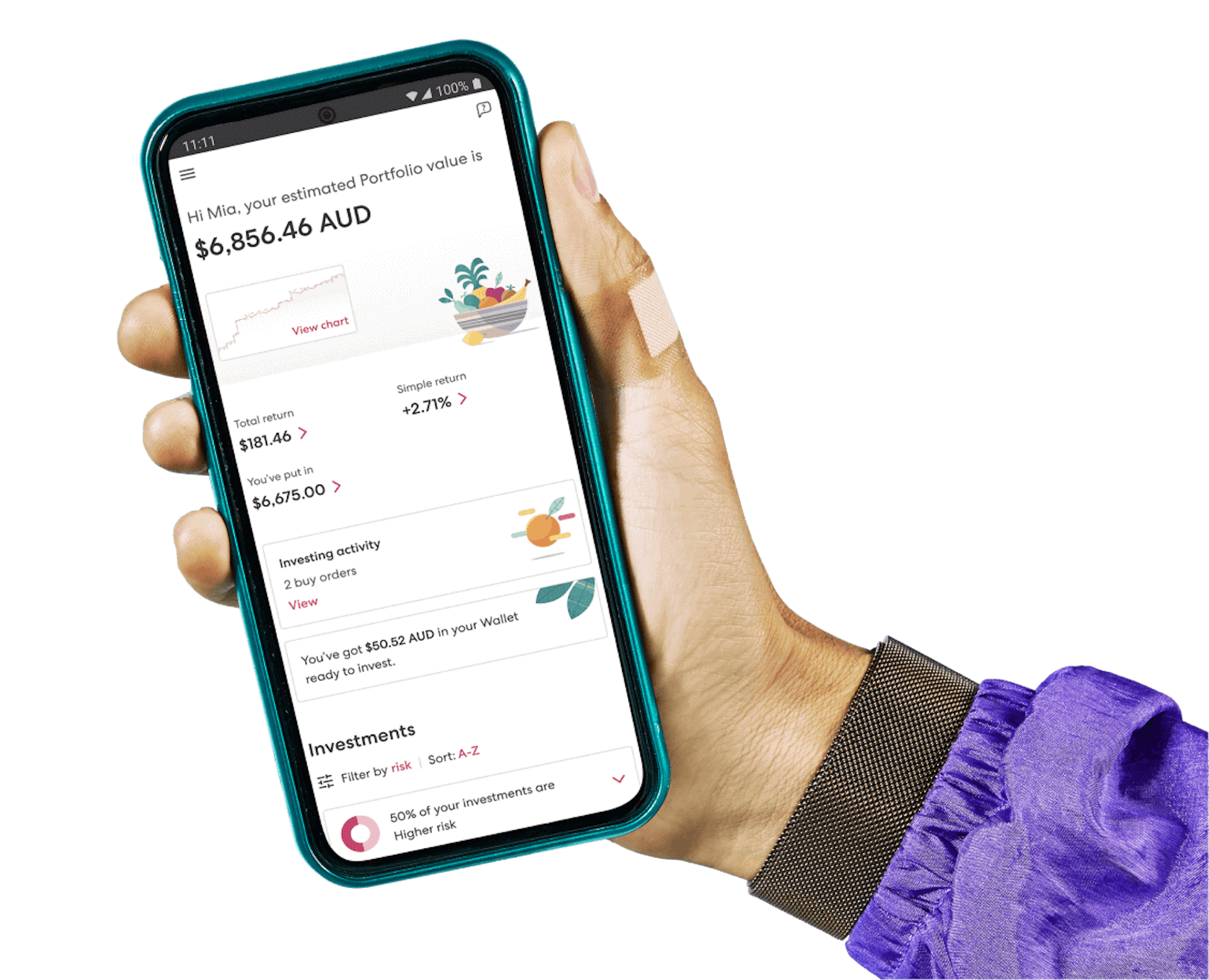

I hear in our community so often, ‘Don’t you need to be rich to invest?’ and I cannot emphasise enough how untrue this is! We’re so lucky to have access to apps like Sharesies that allow you to invest from as little as 1 cent, so you can start investing with whatever you can afford.

Because let’s be honest. When you’re young, you often have less cash flow. Investing regularly (even with small amounts) sets you up with great habits and allows you to learn in a hands-on way.

Plus, the sooner you start, the more time you have to reap the rewards of compound returns. By leaving your money invested, or reinvesting any money your investment pays you over time, you could start to earn returns not just on your initial investment, but on any returns you make along the way.

Round-ups

Make every dollar count by investing extra dollars and cents from your daily spend to reach your goals sooner.

Invest regularly over the long term

I always say that investing is a long game—it isn’t a get-rich-quick scheme. Regular investing helps relieve the stress of any share market ups and downs by taking advantage of dollar-cost averaging.

Dollar-cost averaging is a strategy where you regularly invest the same amount in a particular investment, regardless of the share price, so you can average out your cost per share over time.

Both regular and lump-sum investing can work, but the benefit of regular investing is that it can help minimise emotional decision-making and soften the impacts of share market volatility.

Automate your investing

Why make things harder than they need to be? Automation is a game-changer for building an investing habit and making your goals a reality without having to constantly keep an eye on things.

When things are out of sight, out of mind, you’re less likely to dip into that money for other things. By effortlessly allocating a set amount of money from your income to be invested at regular intervals, you’re ensuring consistency and discipline in growing your wealth without even needing to think about it.

Auto-invest

Put your investing on repeat. Pick an order, the amount you want to regularly invest, and auto-invest will place the orders for you.

Wrapping up

I genuinely believe that you can’t afford not to invest! It’s key to growing your wealth over the long term, so I’m really happy that you’re here and getting started on your investing journey.

If you haven’t already, make sure to find others to connect, learn, and grow with. Whether it’s having an investing buddy to help keep you accountable and motivated (catching up on the market updates over brunch? Sounds like a dream to me!), or joining a community like She’s on the Money, it can be really empowering to learn together and feel that sense of support.

Learn more about simplified investing on Sharesies.

Victoria Devine is not associated with Sharesies AU Pty Ltd or its related companies. Views expressed by Victoria Devine are their views and do not necessarily represent the view of Sharesies. A fee has been paid to Victoria for this article. If any financial product or stock has been mentioned, you should obtain that product's disclosure documents before any decision on whether to acquire the product. Information provided is general only and current at the time.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 600,000 investors